I. Introduction:

Hello, I’m Coach Ledford and welcome to another exciting edition of Your Best Retirement.

As the Good Book says in Ecclesiastes, “A feast makes everyone glad, and wine makes the people merry, but money is the answer for all things!”

Today we are going to start to unpack the #1 question of most retirees:

“Am I going to have enough money to make it to the finish line?”

We are going to take a somewhat practical view of this question by dealing with the tendency to compare ourselves with others along with the resulting anxiety that’s likely to go along with it. I’m not going to leave you there, I’m going to end with a practical way to overcome these challenges, but first a story.

A retired couple went to see their banker taking along all the information about their assets and liabilities then asking her to go over it all and answer the question if they have stored up enough to “make it to the finish line”. They returned to the bank a couple of days later and eagerly awaited their bankers response. Banker said, “ I have good news and I have bad news”. The couple said “give us the good news first.” The banker smiled and said “Yes, you have enough money to make it to the finish line and maintain your current lifestyle as well.” “Then what on earth could be the bad news?” The couple chuckled. The banker replied, “Everything is going to be fine as long as you die by Saturday.”

II. Comparisons

The quickest way to steal your joy or become anxious is to compare your financial state with that of others. There are always going to be people who are better off financially than you and people who are not as well off.

3 Problems with Comparisons

We don’t all begin at the same starting line. Some are born under better circumstances. Some begin with a 10 yard head start in a 100 yard dash. Others actually begin 10 yards behind the rest of us, that’s just the way it is

Some have more resources and support along the way, their family knows the right people, they attend better schools and they are more likely to marry someone who is from an upward trending socio-economic group.

Where you live makes a big difference on the value or purchasing power your wealth holds. Example, my $150,000 house in Kansas would be worth approximately $350,000 in the suburbs of Denver. Wish I could move it there.

III. Here Are The Numbers

We are not going to go by averages because 10% of the households hold 65% of the wealth, so it makes everyone look much richer than they are in reality. We’re going by median household wealth because it shows the family at the 50% mark where half of the households are richer and the other half poorer.

55-64 year old households median net worth $365,000, remember that’s divided by 2 adults, so if you’re single that’s more like $182,500 per each individual.

65-74 year old household median net worth is $410,000.

75+ has $334,000 and declines over time.

IV. Anxiety

It’s easy for the scriptures to say “Do not be anxious about anything” but how do we actually live it?

Look at your past, you’ve made it this far, look how you’ve been favored, write down ten or twenty successes. It will reduce your anxiety level.

One practical action right now is look at one of the major expenses most retirees face and that is the cost of prescription drugs. Lucky for us it’s open enrollment for Medicare Supplement or Advantage customers now through December. Look at your drug plan and see if you can get it cheaper with a different provider.

Paradigm Shift: You can’t out save for a medical or other financial disaster. Even if it does occur as long as you pay the providers a small sum each month, you won’t land in court or in jail for that matter. ha.

V. You Are going to be OK

You are probably not going to die with zero dollars even though that is a worthwhile goal. Even my sainted mother who with no money, a myriad of health problems along with the bills that accompanied the treatment of such and who spent the last few years in the skilled long term care wing of the nursing home, still left the planet with $900 in the bank.

A senior services expert can explain it in more detail but If things really go south for one of you health wise, the healthy spouse can keep up to around $182,000 of cash, a car, your lazy dog and many times even your house. In addition if the healthy spouse has other individual income that belongs solely to them like from a side hustle or investments, they can keep that too.

VI. The Take Away

Don’t pass up memorable experiences just to hoard back more money. Even on a tight budget you can still make extraordinary impact on those you love. There’s always a way to make it work. Help your kids when they need it, and that goes double for the grand kids. Give to causes you care about while you can still influence the outcome. You can’t be generous when you’re dead.

“There is no prize given for being the richest person in the grave yard.”

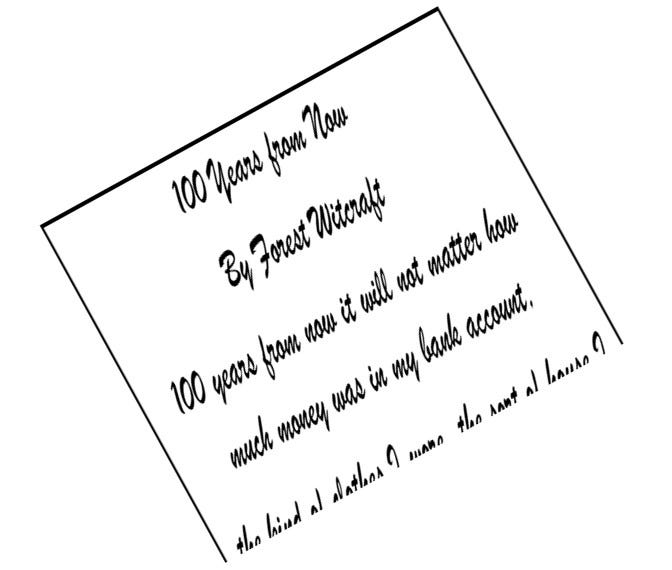

Challenge Tracker: “100 Years From Now”

Below you will find the Challenge Tracker. This week it’s not really a question but rather a poem.

Print it off and place it someplace where you will see it often. It helps to keep all of this in its rightful perspective.

Click the link below.

What do the Scriptures Say?

Ecclesiastes 1:11 No one is going to remember the former generations (that’s us), even those yet to come will not be remembered by those who follow them.

Ecclesiastes 5:11 As goods increase so does the appetite to consume them. And what good are they to their owners except to gaze upon them with their eyes.

Ecclesiastes 5:19-20 When God gives someone wealth and possessions with the ability to enjoy them, to accept their lot in life and to find satisfaction in their work, this is a gift of God, because they will seldom reflect upon their life because God keeps them occupied with gladness of heart.

If you’ve been blessed by this episode, hit the share button down below and send this to a friend.

Remember your legacy is not how much you leave others, but rather the values and precious memories you’ve instilled in them. After all the average beneficiary gets less than $50k and they are already 58 years old. That’s not going to move the needle very much. I hope you’ve had a much fun as I have, I’m Coach Ledford and I look forward to seeing you next time on Your Best Retirement.

Share this post